Schedule A 2024 Form 1099

Schedule A 2024 Form 1099 – A W-2 is an Internal Revenue Service (IRS) tax form that employers use to report how much they However, they get less control over their work schedule. 1099 contractors have the opposite . The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for .

Schedule A 2024 Form 1099

Source : blog.checkmark.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

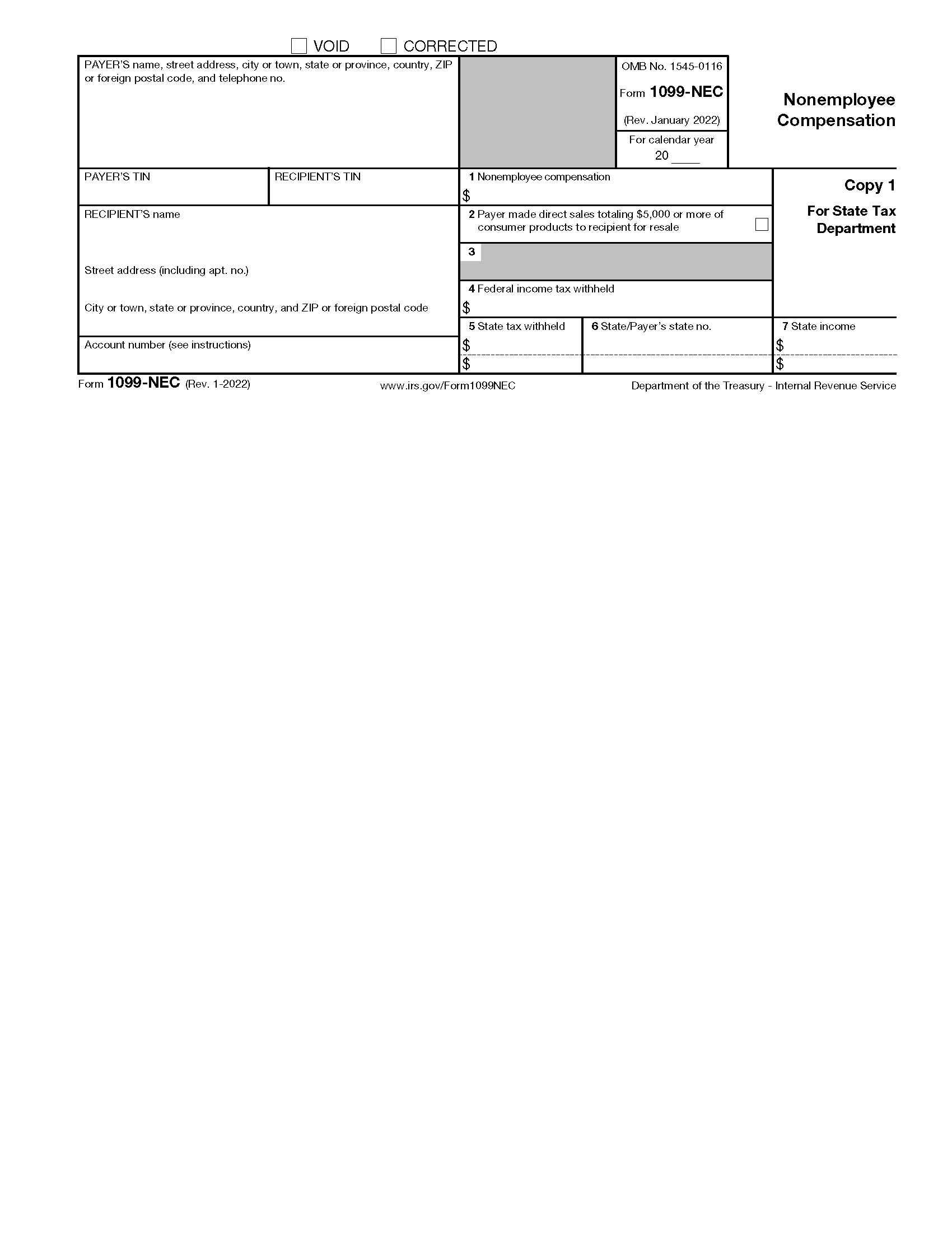

Source : taxschool.illinois.eduFree IRS 1099 NEC Form (2021 2024) PDF – eForms

Source : eforms.comUnderstanding the 2024 Version of Form 1099 DIV BoomTax

Source : boomtax.com2024 Form 1099 B Draft Comply Exchange

Source : www.complyexchange.comIn Depth 2024 Guide to 1099 MISC Instructions BoomTax

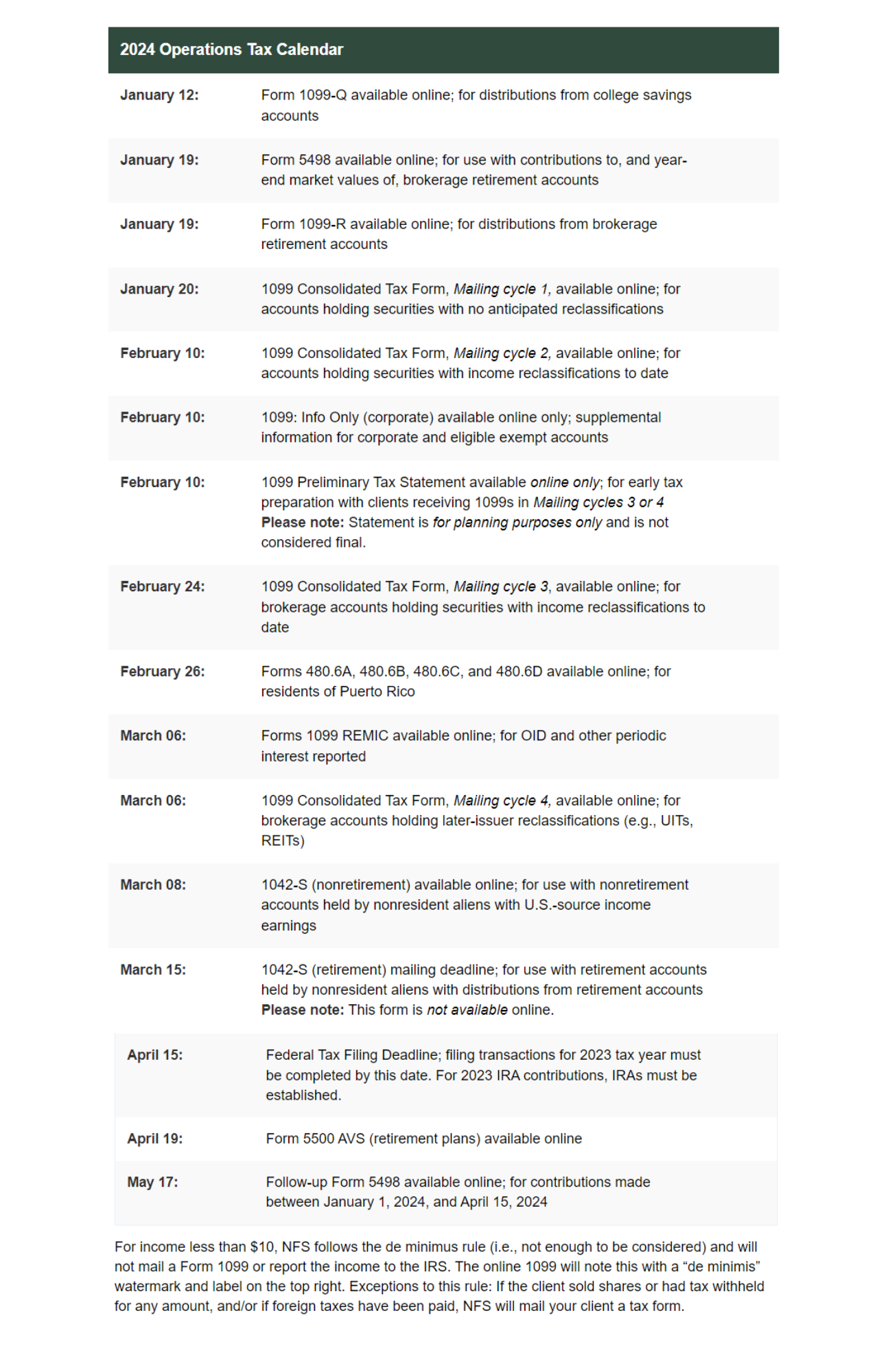

Source : boomtax.comTax Center — Integrated Equity Management

Source : www.integratedequity.netIRS Announces Big Changes To Form 1099 K, Including Another

Source : www.forbes.comIRS announces delay in Form 1099 K reporting threshold for third

Source : www.linkedin.comWhen To Expect Your Forms W 2 & 1099 In 2024—And What To Do If

Source : www.forbes.comSchedule A 2024 Form 1099 How to File 1099 NEC in 2024 — CheckMark Blog: The IRS is planning a threshold of $5,000 for tax year 2024. A 1099-DIV is typically the “other income” line of a 1040 form, which is reported on line 8 of Schedule 1. There’s no perfect . Knowing when to issue which kind of 1099 form to someone you paid money to can be confusing to small business owners, but we’ll try to clear up any confusion. .

]]>