2024 Form 1040 Schedule D Instructions List

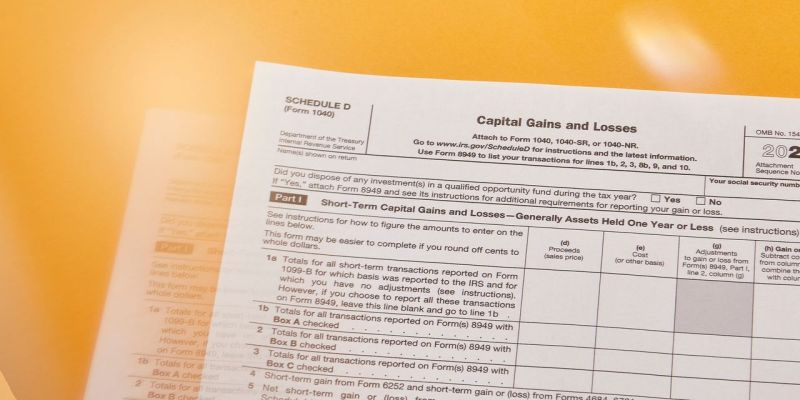

2024 Form 1040 Schedule D Instructions List – Before completing Schedule D, you must list all of the capital assets you In order to complete this worksheet, you will need to complete Form 1040 through line 43 to calculate your taxable . Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money .

2024 Form 1040 Schedule D Instructions List

Source : www.irs.govPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFederal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet

Source : sites.google.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFiling taxes for your restricted stock, restricted stock units, or

Source : workplaceservices.fidelity.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1040 Schedule D Instructions List 1040 (2023) | Internal Revenue Service: List assets, dates acquired, dates sold, sales price and other pertinent information in the appropriate columns. Form 8949 instructions and Part II on Schedule D of Form 1040. . Check out the complete list and if any of these and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found in the Form 1040 instructions booklet. These worksheets take .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)